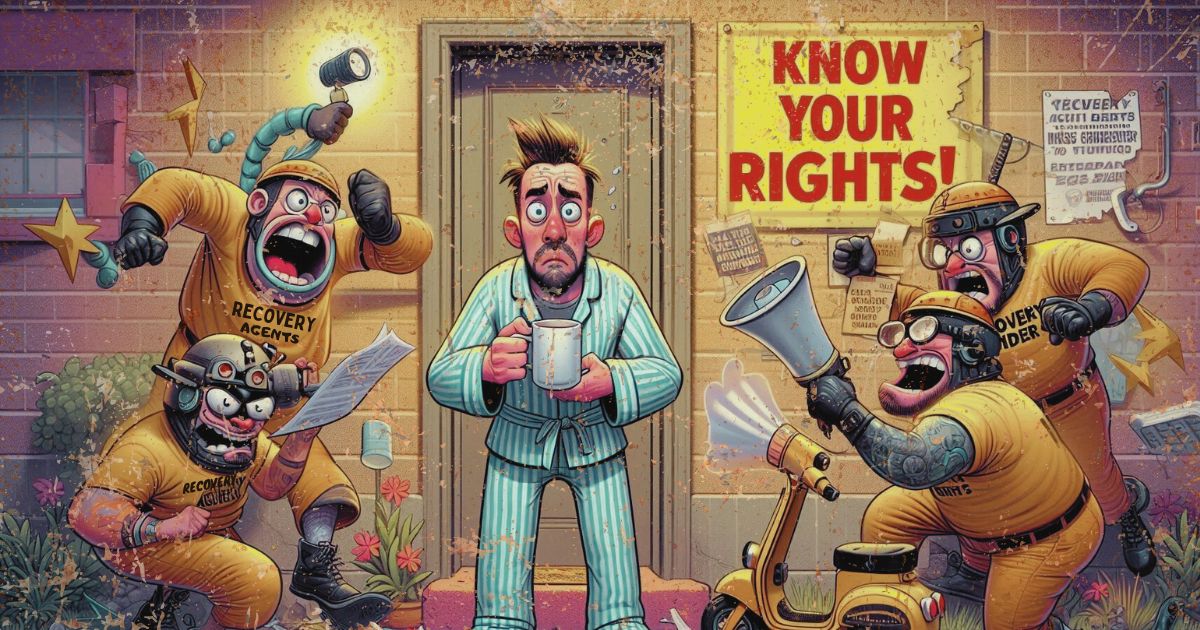

· Recovery Agent Harassment · 4 min read

When EMI Collections Cross the Line: Cybercrime and Data Privacy Violations by Bank Agents

When Equated Monthly Instalments (EMIs) go unpaid, borrowers often face aggressive collection tactics that can infringe on their legal rights and data privacy. This blog explores the unethical practices employed by some collection agents, including harassment and unauthorized access to personal data.

Equated Monthly Instalments (EMIs) provide a manageable way for borrowers to repay loans, but defaulting can lead to aggressive collection practices that often violate ethical and legal standards. This article delves into the troubling tactics used by some collection agents, including harassment and the misuse of personal data, raising critical concerns about data privacy and cybercrime. By exploring the emotional impact on borrowers and their contacts, we emphasize the importance of understanding legal rights and available recourse to combat these abuses.

Understanding EMI Collection Practices

EMIs enable borrowers to repay their loans in reasonable monthly amounts. When borrowers default, banks initiate the collection procedure, which typically starts with reminders via phone calls, emails, and SMS. If payments continue to be missed, banks often hire collection agents to recover the debts. While these practices are lawful, some tactics employed by collection agents can be unethical and illegal, resulting in harassment and data privacy violations.

In many cases, agents—often employed by third-party companies—misuse borrowers’ personal information, including contact lists. This raises serious concerns regarding data privacy, cybercrime, and the psychological impact on borrowers and their close contacts.

Cybercrime Concerns: Unauthorized Access to Contacts

Unauthorized access and exploitation of a borrower’s contact list are typical unethical practices in EMI collections. Many financial organizations and lending apps require borrowers to provide their mobile contacts upon signing up. While this information is intended for verification purposes, unethical collection agents frequently abuse it by contacting the borrower’s friends, relatives, or colleagues.

These agencies exert indirect pressure on the borrower by implicating their social network, leading to feelings of embarrassment and urgency. The manipulation of private information constitutes a significant breach of trust and privacy. Accessing and using someone’s contact list without their permission is not only unethical but also unlawful under data protection legislation, such as India’s Information Technology Act of 2000, which governs the processing of personal data.

Such actions are a form of cybercrime because they involve unauthorized access to personal information. Unfortunately, many borrowers are unaware of their legal rights to combat such abuses and often feel helpless in the face of aggressive tactics.

The Effects of Harassment on Borrowers and Their Contacts

Borrowers and their contacts may experience significant emotional and psychological distress as a result of harassment. Those already struggling with financial difficulties may feel even more anxious and embarrassed when collection agents contact their social circle. This can damage relationships, disrupt professional lives, and create feelings of isolation for the borrower.

Contacts who are not involved in the financial transaction may receive threatening or coercive calls, exacerbating their mental turmoil. Friends and family members may feel angry, confused, and helpless due to privacy concerns.

In severe cases, collection agencies may publish defamatory statements on social media or send public messages, further exacerbating emotional and reputational harm. Such actions clearly violate privacy and may constitute criminal behavior under cyber harassment laws.

Legal Recourse: Ensuring Your Privacy and Rights

Borrowers and their contacts are legally protected from such harassment and data privacy violations. Several legal options are available to safeguard one’s rights:

Information Technology Act of 2000: This Act prohibits unauthorized access to personal data, including contact lists. Sections 43A and 72A penalize organizations and individuals for misusing personal information. Victims can submit complaints against collection agents and the financial institutions they represent.

RBI Guidelines: The Reserve Bank of India (RBI) has issued guidelines for collection agents’ conduct, mandating them to treat borrowers with respect and refrain from harassment. Borrowers can file complaints with the bank and escalate the issue to the Banking Ombudsman if unsatisfied with the response.

Right to Privacy: The 2017 Supreme Court ruling on the right to privacy affirms that personal data and privacy are fundamental rights under Article 21 of the Indian Constitution. Borrowers may take legal action if their privacy is breached.

Filing a FIR: In cases of significant harassment, including threats and abusive behavior, borrowers can file a First Information Report (FIR) with local police or the cybercrime division to pursue legal action.

Conclusion

While EMI collection is necessary, crossing ethical and legal boundaries is unacceptable. Harassment and cybercrime by collection agencies violate borrowers’ privacy and must be addressed legally. Understanding one’s rights and taking necessary action can empower borrowers and their contacts to combat overreach and abuse.

.DfnmLVRx_ZWkjQQ.webp)