· Recovery Agent Harassment · 3 min read

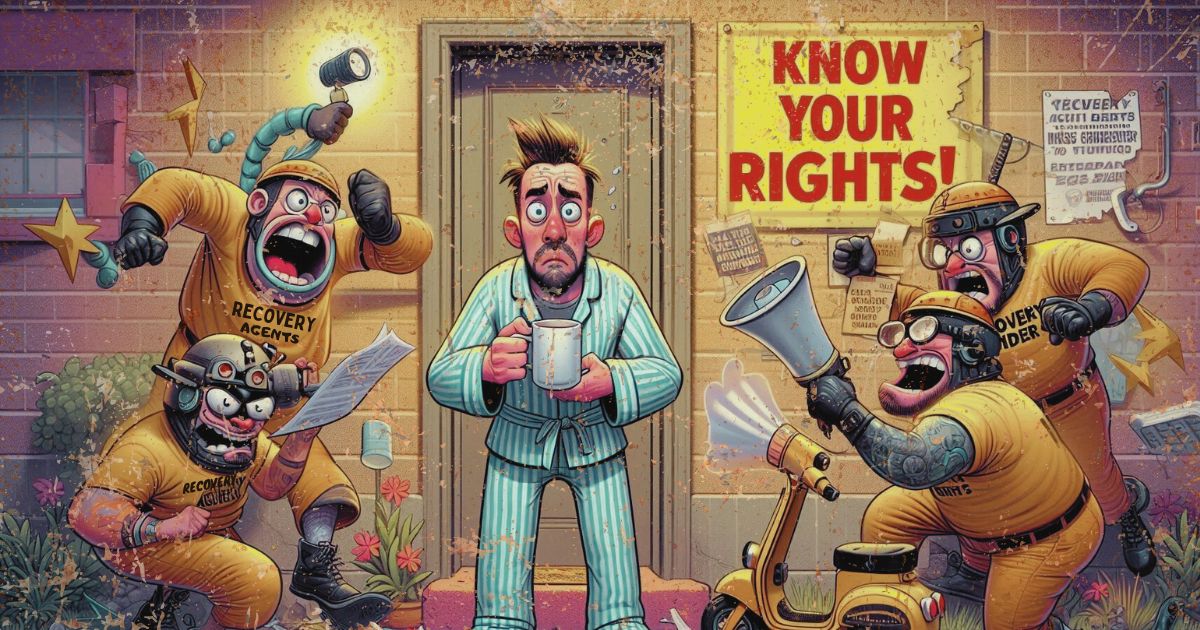

Struggling with EMI Payments? Know Your Rights!

Are recovery agents pressuring you over unpaid EMIs? Learn about your legal rights and protections under Indian law. Understand illegal intimidation tactics, misrepresentation, and how consulting a financial advisor or lawyer can help you manage your situation effectively.

Are you having trouble making your EMI payments, or are recovery agents harassing you? It’s essential to seek help from a financial advisor or lawyer who can guide you through these challenges and ensure your rights are protected. Professional legal advice can provide you with the clarity and support you need during this stressful time.

Understanding Your Rights Against Illegal Threats

Many individuals find themselves in intimidating situations when they fall behind on EMI payments. Recovery agents often resort to threats and coercive tactics, which can add to the stress of financial difficulties.

Legal Perspective: Indian law prohibits recovery agents from using coercive methods against debtors. Threats about filing FIRs (First Information Reports) for outstanding loans are illegal. The Reserve Bank of India (RBI) has established regulations that recovery agents must follow, ensuring ethical practices and safeguarding borrowers’ rights. If you encounter such threats, it’s important to remember that you have the right to report these actions.

Understanding FIRs and Criminal Cases

Recovery agents may threaten to file an FIR against you for non-payment of EMIs, causing unnecessary panic and confusion.

Legal Aspect: FIRs are meant to report criminal offenses, not civil disputes such as loan recovery. Financial disputes are categorized as civil cases and cannot be addressed under criminal law. If recovery agents threaten you with criminal action for defaulting on EMIs, know that these threats are baseless and illegal.

Your Rights Against Misrepresentation

Recovery agents can misrepresent various aspects of your financial obligations, such as the nature of the debt or potential consequences of non-payment.

Legal Perspective: Recovery agents are prohibited from making false claims about debts or misleading borrowers. The RBI mandates transparency and honesty in debt recovery practices. If you experience misrepresentation, it’s advisable to document these incidents and seek legal assistance.

RBI Guidelines for Recovery Agents

The RBI has laid out specific rules governing the behavior of recovery agents to protect borrowers from harassment and unauthorized practices.

Legal Perspective: These guidelines prohibit recovery agents from using intimidation or misrepresenting facts. If you encounter violations of these rules, you can report the agent to the RBI, which will take necessary actions against them. Familiarizing yourself with these guidelines can help you assert your rights.

The Importance of Professional Consultation

If you’re facing harassment from recovery agents or dealing with complex EMI issues, consulting a legal expert or lawyer is crucial. They can provide accurate guidance, help you understand your rights, and navigate the process of addressing illegal practices.

Conclusion

Dealing with EMI payments and recovery agents can be overwhelming. However, knowing your rights can offer you much-needed relief. Threats, false claims, and misrepresentation are unacceptable under Indian law, and you have the right to challenge and report them. By understanding the RBI guidelines and seeking professional advice, you can better navigate these challenges and protect your financial well-being.