· Home Loan Tips · 3 min read

ARE YOU LEAVING MONEY ON THE TABLE? UNLOCK SMART SAVINGS ON YOUR HOME LOAN

Are you overpaying on your home loan? Discover how RBI rules, EMI tweaks, and proactive steps can help you save big. From reducing interest costs to smart lender switches, take control of your finances today. Is your home loan working as hard as it should for you?

(Expertpanel) ARE YOU LEAVING MONEY ON THE TABLE_ UNLOCK SMART SAVINGS ON YOUR HOME LOAN.rfWqvUcc.jpg)

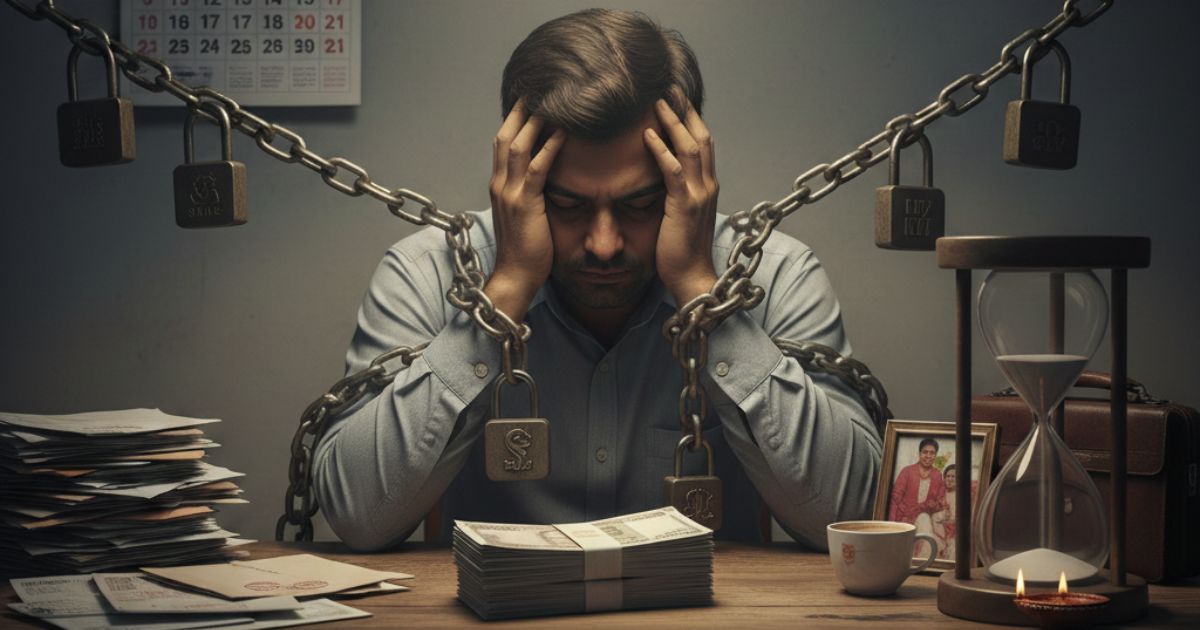

Let’s face it—buying a home might be the most significant financial commitment you’ll ever make. But did you know that a few smart tweaks to your loan could help you save a fortune? Your home loan doesn’t have to feel like a financial ball and chain. With some practical insights, you can transform it into a tool for saving money!

What’s the Secret Sauce to Cutting Your Interest Costs? The Reserve Bank of India (RBI) has implemented borrower-friendly policies to make loans more manageable. They’ve rolled out rules that increase transparency on interest rates and fees. But here’s the catch—you’ve got to know about these benefits to use them! Think of it like finally being able to decode the fine print without hiring an expert.

How Can You Become a Home Loan Whiz Without Getting a Finance Degree? You don’t need to be a financial guru to outsmart your home loan. The internet is a goldmine for resources—from blogs and YouTube tutorials to free online finance courses. They simplify complex topics into easy-to-grasp lessons. It’s like having a personal financial coach, but without the hefty price tag!

Are You Taking Advantage of Rate Cuts? When the RBI reduces interest rates, it’s like giving borrowers a golden opportunity to save. But here’s the twist—your bank might not automatically pass on those benefits. You’ll need to be proactive and request the rate adjustment. Don’t hesitate; after all, it’s your money at stake!

What’s This EMI Magic Everyone’s Talking About? Heard of EMI reduction? It’s not just financial jargon—it could be your gateway to significant savings. When interest rates drop, you have two options: maintain your EMI to pay off the loan faster, or reduce your EMI to boost your monthly cash flow. It’s like choosing between a sprint or a steady jog—both will get you to the finish line, but the approach depends on your goals.

Could Switching Lenders Be Your Golden Ticket? Sometimes, switching your home loan to another bank really can save you money. Thanks to the RBI’s rules, transferring your loan is now simpler than ever. It’s like upgrading from an old, inefficient gadget to a sleek, modern one. But tread carefully—do thorough research before making any decisions to ensure it’s worth the move.

Ready to Take Control of Your Home Loan? You’ve got the tools—now’s the time to put them to use! Start by speaking with your lender to understand how the latest RBI guidelines can benefit you. Don’t accept the first offer you get—compare alternatives to find the best deal. Remember, being informed gives you the upper hand, especially when managing your finances.

In a nutshell, your home loan doesn’t have to be a daunting financial enigma. With a bit of effort and access to the right resources, you can turn it into a stepping stone to financial growth. So, take charge of your home loan today—your future self and your wallet will thank you!