· RBI Guidelines · 4 min read

RBI Guidelines on Recovery Agents: What Every Borrower Should Know | ExpertPanel

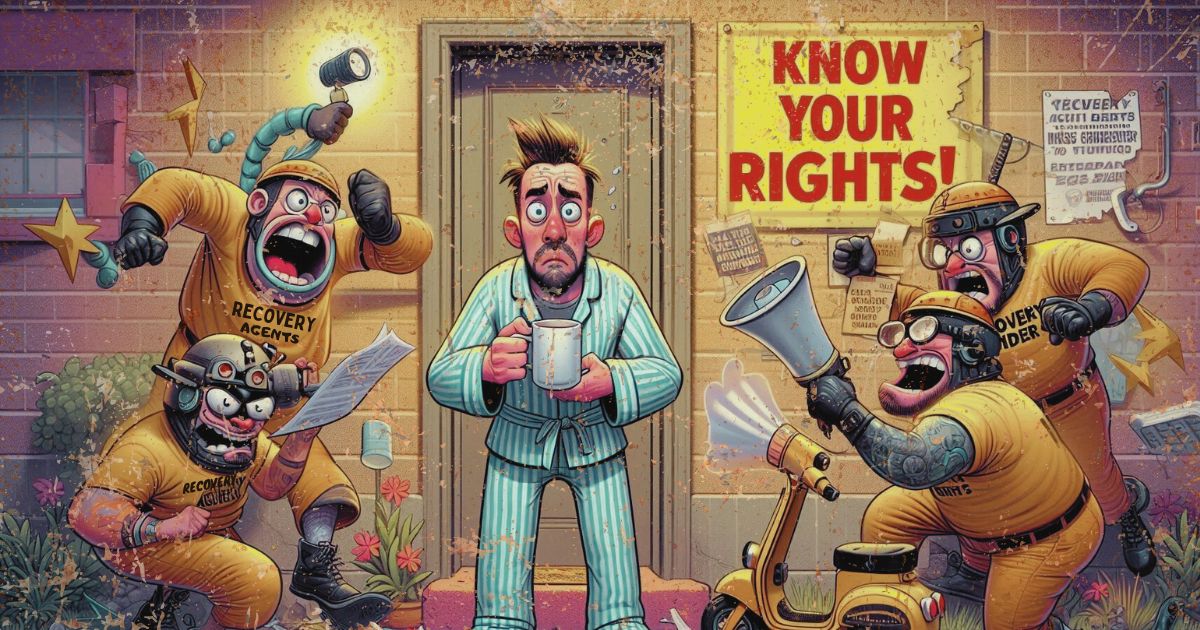

Understand RBI’s rules for recovery agents, what counts as harassment, and the legal remedies borrowers can use to protect themselves from unfair debt collection practices.

If you’ve ever missed a few EMIs, you know the anxiety when the phone rings from an unknown number. Sometimes it’s a polite reminder; other times, it’s someone speaking in a way that feels more like intimidation than communication. That’s where the Reserve Bank of India (RBI) steps in — they’ve actually laid down rules for how banks and NBFCs can use recovery agents, and what those agents can and cannot do.

This isn’t just fine print buried in some circular. These guidelines exist to protect borrowers from harassment while still allowing lenders to recover their dues legally and rightfully. Let’s break it down.

1. Introduction to RBI Recovery Guidelines

RBI knows that loan recovery is necessary, but it’s equally aware of the misuse of power by some agents. So, it has made rules that every bank, NBFC, or financial institution must follow when appointing recovery agents.

For example:

Agents must be properly trained and certified before they interact with customers.

Borrowers must be informed in advance (often in writing or via SMS/email) that a certain recovery agency will be contacting them.

All conversations and visits should be conducted professionally with no abuse or threats.

Think of it as RBI saying, “You can ask for your money back, but you can’t forget basic decency while doing it.”

2. Recovery Agent Do’s and Don’ts

What they should do:

When they come to meet you, they should have a proper ID card and a letter from the bank showing they’re officially assigned to your case.

Contact you only during reasonable hours — between 7 AM and 7 PM.

They should speak politely to you, even if you owe money.

Be clear about how much you owe and explain the breakup if you ask.

What they shouldn’t do:

Shout at you, use abusive language, or make you feel threatened.

Show up unannounced again and again just to pressure you.

Call your relatives, friends, or workplace to embarrass you about the loan.

They shouldn’t visit your home/work in a way that feels like you’re constantly watched.

3. What Is Considered Harassment?

Harassment isn’t just someone yelling at you over the phone. It can be:

Calling you 20 times a day.

Showing up at your home unannounced again and again.

Making threatening remarks like “We’ll ruin your reputation” or “Your family will face trouble.”

Publicly shaming you — for example, telling neighbors about your dues.

Even subtle pressure, like calling at odd hours or involving unrelated third parties, can count as harassment under the RBI’s view.

4. How to Protect Yourself from Illegal Recovery Methods

When an agent visits, ask for their ID and authorization letter. You’re within your rights to refuse the conversation if they don’t have these. And remember — no matter how bad your financial situation is, you don’t have to tolerate threats or abuse.

5. How to File a Complaint if Guidelines Are Violated

If an agent crosses the line, here’s what you can do:

Write to your bank/NBFC first — specifically to their grievance redressal officer. Mention dates, times, and exactly what happened.

If the bank ignores you or fails to respond within 30 days, escalate the matter to the RBI Banking Ombudsman.

Keep copies of all your emails, letters, and call records — they help prove your case.

6. Legal Remedies Available for Borrowers

Apart from the RBI’s framework, Indian law also offers protection:

Indian Penal Code (IPC): sections can be invoked if an agent uses criminal force, issues threats, or trespasses.

Consumer Protection Act: can be used if the recovery process is unfair or causes mental distress.

Civil Courts: can be approached for injunctions to stop harassment.

The point is, you’re not powerless. Recovery agents may have the bank behind them, but the law — and RBI’s rules — are on your side if they step outside the line.

End Note

If you’re in debt, yes, repayment matters. But so does your dignity. RBI’s guidelines exist so that financial recovery doesn’t turn into personal trauma. Knowing these rules isn’t just useful — it’s your shield.

Must Read: recovery-agent-red-flags-borrower-rights