· Recovery Agent Harassment · 4 min read

Essential Tips for Dealing with Bank Agents at Home

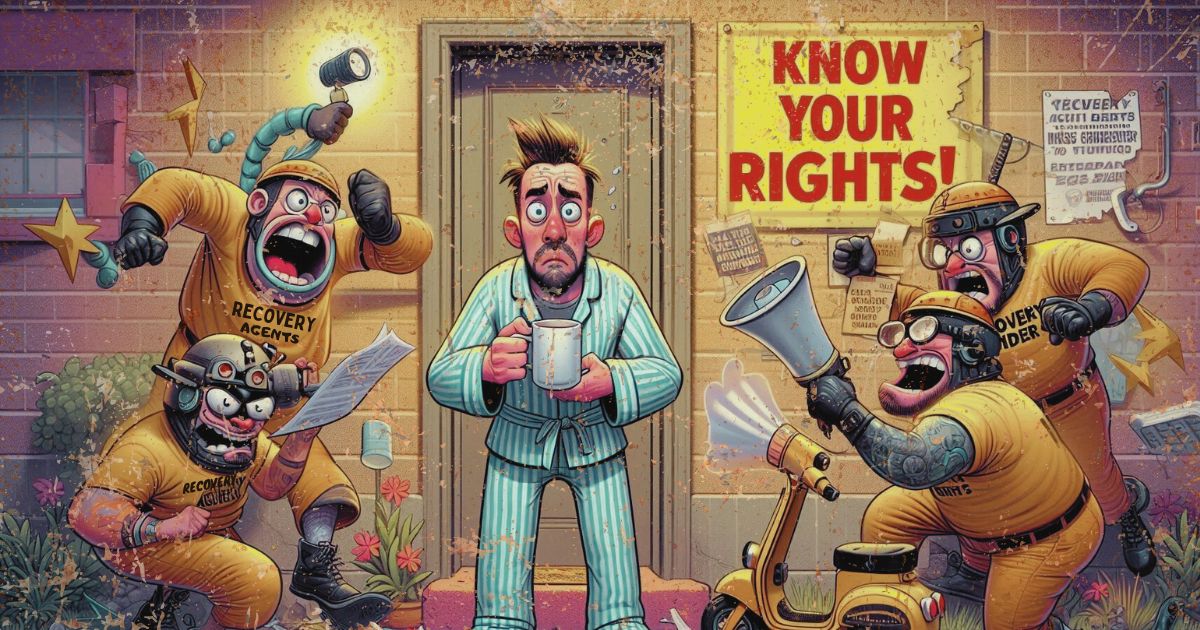

Bank representatives visiting your home for debt collection or other purposes can feel intrusive, but knowing your rights can help you maintain privacy and control. This guide offers essential tips on handling such visits professionally while safeguarding your personal space, including understanding your rights under RBI guidelines, verifying the agent’s identity, and taking follow-up actions to protect your privacy.

.DfnmLVRx_ZWkjQQ.webp)

Bank representatives are frequently sent to collect debts, confirm information, or sell financial products. While their visits may be justified, they can also feel unwelcome or intrusive. Many people are unaware of their rights when a bank representative visits their home. In these situations, it’s critical to know how to maintain professionalism while protecting your privacy. The purpose of this post is to safeguard your rights and personal space while offering advice and strategies for interacting with bank agents at home, particularly in the Indian context.

Understanding Your Rights

Right to privacy: A bank representative is not authorized by law to break into your home or demand entry into your personal belongings. You are not obliged to host them in your home.

Right to verification: Always confirm the bank agent’s identity. Request their official identification, the bank’s letter of authority, and a clarification of their visit’s purpose. To verify their authenticity, call your bank.

Right to respect and dignity: Bank employees are required to act with professionalism and respect your privacy. Coercion, harassment, or hostile behavior is expressly prohibited under RBI norms.

Hours of operation: Bank representatives are only allowed to visit from 7 a.m. to 7 p.m. Any visit outside of these times is a violation of your rights.

Strategies for Handling the Visit

a) Remain composed and calm: Bank visits can be nerve-wracking, particularly if they are intended to recover loans. It’s important to maintain your composure. Recognize that agents are performing their duties, but you do not have to sacrifice your privacy to appease them.

b) Evaluate the reason for the visit: Find out from the agent why they are there. Check if the information collection can be done over the phone or online. If they are visiting to recover a debt, inform them that you would prefer to discuss the matter formally at the bank or through written correspondence.

c) Maintain a brief conversation outside your home: Preserve your privacy by not allowing agents inside your home. Keep the conversation brief and have it outside or at the door. Politely inform the agent that while you appreciate their visit, you would rather deal directly with the bank.

d) Document the exchange: It’s wise to take notes or record the visit for future reference. If there are any disputes over the agent’s actions, this can serve as evidence.

e) Take advantage of technology: With the rise of online and mobile banking, most financial affairs can now be handled digitally. Ask the agent to move any questions or follow-up steps online to minimize the need for further house visits.

After the Visit: Follow-Up Actions After the bank agent’s visit, ensure that you have complete control over your finances and privacy.

a) Record the visit: Write down the agent’s name, ID number, visitation time, and objective. Document any issues that arose during the visit, such as privacy violations or unethical conduct.

b) Interact with the bank: After the visit, contact the bank via official channels like email or customer service. Discuss the visit and request that all future communications occur online or at a prearranged location.

c) Examine financial commitments: If the visit was related to loan recovery, review your obligations and repayment options. Seek legal or financial assistance if needed on how to manage debt. Never let a bank agent’s visit lead to rash decisions.

d) Take further action if necessary: If you feel that the agent harassed you or visited outside of business hours, report them to the Banking Ombudsman or the bank’s grievance redressal system. The RBI has strict guidelines to prevent recovery agents from unfairly harassing customers.

Conclusion

Although dealing with bank representatives at home can feel invasive, you can safeguard your privacy and personal space by being aware of your rights and learning how to handle these encounters. The RBI in India offers clear guidelines on how bank employees should conduct themselves, ensuring that you are treated with dignity and respect. By staying calm, verifying the reason for the visit, and taking appropriate follow-up actions, you can manage these situations without compromising your privacy. Remember, your home is your haven, and your privacy always comes first, regardless of your financial obligations.