· Recovery Agent Harassment · 5 min read

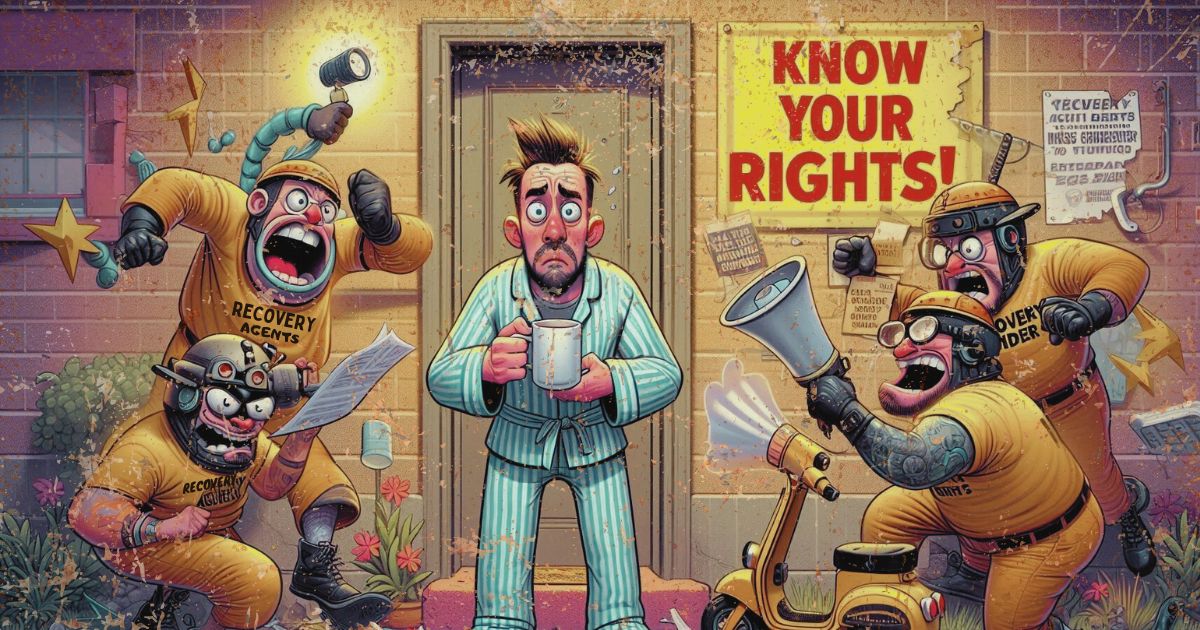

Can Recovery Agents Seize Your Assets or Harass You? Know the Truth

Can recovery agents take your home or salary? Know your rights, what they legally can and can’t do, and how to protect yourself from harassment.

You have likely received calls from the recovery agents if you have ever defaulted on paying your EMIs. Some recovery agents speak politely, and many frighten you, frightened by threats such as that they will take your house or will block your salary.

OK, let it be known—much of that is hot air. This is what they can do, what they cannot do, and how you may protect yourself.

1. What are the Rights of Recovery Agents Anyway?

The recovery agents are just brokers hired by banks or Non-Banking Financial Companies (NBFCs) to collect late payments. They do not possess real legal authority, such as the police or the courts. Their job is mostly to remind you, convince you, and push you to make a payment.

They don’t have permission to go into your house. Just because they live in the same house with you does not mean that they can take your car or bicycle, and they shouldn’t be able to get their dirty hands on your paycheck. If they threaten you with something, they’re over the line.

2. Guidelines on Asset Seizure – RBI

The Reserve Bank of India (RBI) set out certain rules: recovery agents are allowed to take custody of any asset only with the right permission. Although your loan may be secured (such as a car loan or home loan), no one except the lender can force repossession (and then only through the prescribed process of law).

The reacquisition must take place through proper notices and documents. It can never happen as one wrathful bill collector appearing with two persons at your gate.

3. Court-Ordered Action vs Recovery Agents – Difference

The important distinction is in the following:

Court or tribunal order: The bank can take you to the Debt Recovery Tribunal (DRT) or court if you are unable to pay. Only at this point can the bank confiscate your property, salary, or other assets.

Recovery agent threats: These are not legal. They may threaten to bring a civil suit by telling you that they will do so, but until there is a court order, they can do nothing to your material other than warn you that they will.

Here is how to think about it: Agents can scream, but only a judge can rule.

4. Threats Used by Agents (Commonly) – and the Way to Go About Them

You will hear much said:

“We are going to get your house tomorrow.” → This cannot be done without a process of law.

”We will ring up your office and humiliate you.” → Contrary to the RBI provisions. Bullying/defamation is a crime.

”We will freeze your passport.” → Total lie. This can be done only by a court or a governmental agency.

The most appropriate approach to deal with these is as follows: remain composed, avoid engaging in arguments, and make some recordings of their saying. In case they step over the line, you will have such records to make a complaint.

5. Protect Your Home, Car and Salary

Home/Property: Inaccessible—it would be impossible to touch it without a mortgage and going through a legal repossession by the bank.

Car/Vehicle: In the event it is going to be repossessed, yes—but that would be after due notice and not at 2 AM.

Salary: Nobody can tamper with your salary. Attachment of income can only be done in a court of law.

Therefore, no recovery agent can reclaim your house, salary or other personal assets, unless a legal notice or a court order is visible.

6. Lodging of Complaints Over Abuse of Authority

When an agent threatens you, mistreats you, or tries to force his or her way into your house, you can do something:

The bank needs to take responsibility for the people they hire — their representatives speak and act on the bank’s behalf, and customers shouldn’t have to pay the price for their mistakes.

Write to RBI on their grievance portal.

When it is serious harassment, report it to the police.

RBI is quite categorical that recovery must be “fair and dignified.” In case agents are testing that boundary, you have the right to push them away.

Must Read: https://expertpanel.org/blog/expertpanel-rbi-guidelines-recovery-agents-borrower-rights/

FAQs

1. Can recovery agents really take my house or car?

Not without a proper legal process. They can’t just show up and take your property. Only courts and lenders, with due notice, can do that.

2. Can they call my office and embarrass me?

No. That’s illegal and against RBI rules. You can file a complaint if a recovery agent threatens to contact your employer or defame you.

3. Can they take money directly from my salary or freeze my bank account?

Absolutely not. Only a court can order salary attachment. Recovery agents have zero authority over your income.

4. What should I do if a recovery agent threatens or harasses me?

Stay calm, record the conversation if possible, and lodge a complaint with the bank, RBI, or even the police if the harassment takes a serious turn.

5. Is missing EMI a crime? Can I go to jail for not paying my loan?

No, loan default is a civil issue, not a criminal one. You won’t go to jail, but banks can take legal action through proper channels.

.DfnmLVRx_ZWkjQQ.webp)