· Debt Awareness · 5 min read

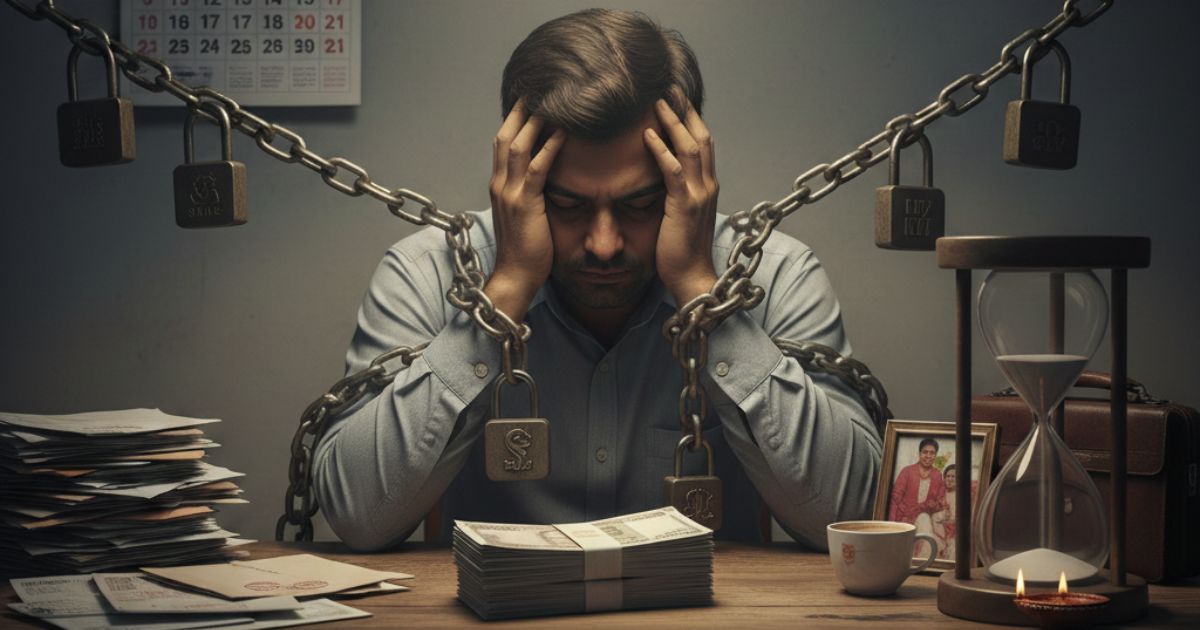

Borrowed to Invest? Why Using a Loan for High-Risk Investments is Dangerous

Borrowing to invest in crypto, gold, or stocks may seem profitable but often leads to mounting EMIs and debt. Learn why using loans for risky investments is dangerous, its legal impact, and safer ways to build wealth responsibly.

Over the past few years, there has been an increasing trend of Indians considering new sources of investment like cryptocurrency, gold trading, and stocks. Although these options can be profitable, they are also highly volatile and uncertain. Some people borrow money by taking personal loans or using credit cards to invest, hoping to make quick returns. However, this often leads to a debt spiral instead of financial success. It’s important to understand the dangers of borrowing to invest before making such a risky decision.

Typical Scenario: Taking a Personal Loan for Investment

A common situation involves an investor being lured by the rising stock markets or the skyrocketing prices of cryptocurrencies. The easy accessibility of personal loans from banks and online lending apps leads many individuals to borrow money with the hope of multiplying their earnings in a short time. They view it as a chance to earn a profit higher than the loan’s interest rate.

For instance, an individual may borrow ₹2,00,000 at 14% per annum, believing that the market will yield a 30% return. However, when the market falls, the investor not only loses potential profit but must also repay the loan with interest , turning the gamble into a financial burden.

Why This is Risky: Interest Costs, Investment Volatility, and the Debt Trap

Borrowed money comes with a fixed repayment obligation, unlike using your own savings. The markets are unpredictable, and investments do not always yield returns high enough to cover interest and loan charges , even when the investment seems promising.

This creates a situation where the borrower is paying EMIs using salary or savings instead of building wealth.

If the investment fails, the borrower remains liable for both the principal loan amount and accumulated interest. This can lead to a classic debt trap, where new loans are taken to pay off old ones. Over time, financial stress increases, EMIs are missed, and the borrower’s credit score and future borrowing capacity are severely affected.

Case Study: Loan Taken for Crypto, Gold, or Equity and the Fallout

Let’s consider individuals who borrowed to invest in cryptocurrencies, gold, or stocks. When market crashes occurred — such as during the 2022 crypto slump — many borrowers faced massive losses while still owing EMIs.

They were forced to sell assets or take additional loans to cover debt payments. Some even defaulted, damaging their credit profiles for years.

The key takeaway: borrowing for volatile investments multiplies risk rather than return.

Legal Implications if Investment Fails and You Default

A loan default doesn’t just bring financial loss , it also has legal consequences in India. Most loan contracts allow lenders to initiate recovery actions in case of non-payment.

Defaults negatively affect your CIBIL score for up to seven years, making it difficult to secure future loans.

While creditors can file civil suits or engage recovery agencies, they must follow Reserve Bank of India (RBI) guidelines and cannot use intimidation or harassment.

If the amount involved is large, banks may even declare you a wilful defaulter, especially if funds were used for speculative trading like crypto or stock investments. This classification can severely limit your future access to credit or financial services.

Safer Alternatives: Emergency Funds, Systematic Investing, and Diversification

Instead of borrowing to invest, financial experts suggest building an emergency fund equal to at least six months of expenses. This ensures liquidity during market downturns.

Investors can choose Systematic Investment Plans (SIPs) in mutual funds, allowing small, regular investments while spreading risk over time.

A balanced portfolio can also be achieved through diversification , spreading investments across fixed deposits, mutual funds, government bonds, and gold ETFs , avoiding high debt risks.

Credit should be used only for productive or income-generating purposes, such as business expansion, education, or home ownership ,, not speculative trading.

How to Unwind If You Already Borrowed and Things Are Going Bad

If you’ve already borrowed to invest and your returns are declining, take these steps immediately:

Stop borrowing further. Don’t take new loans to recover old losses.

Assess your total debt and focus on repaying high-interest loans first.

Convert short-term loans into longer-tenure ones to reduce EMI pressure.

Discuss restructuring or settlement options with your lender.

Sell underperforming investments, even at a loss, to limit further debt.

Seek financial or legal counselling before the situation escalates into a default.

Summary: Match the Right Kind of Borrowing to the Right Purpose

Borrowing can be a powerful tool when used wisely — but using debt for high-risk investments is a dangerous shortcut that often turns ambition into burden.

The golden rule is simple:

Never invest borrowed money into markets where returns are uncertain.

Instead, borrow for productive purposes such as education, business, or housing — and reserve your savings for high-risk investments.

Building wealth is a marathon, not a sprint. Disciplined investing always outperforms risky borrowing in the long run.

FAQs

1. Can I take a personal loan to invest in the stock market?

It’s not advisable. Market returns are uncertain, while loan repayment is fixed, increasing your financial risk.

2. What happens if I default on a loan taken for investment?

Your credit score will drop, lenders may initiate recovery actions, and you could be blacklisted as a wilful defaulter.

3. Are there safe investment options without borrowing?

Yes. SIPs, government bonds, and diversified mutual funds allow you to grow wealth steadily without loans.

4. What should I do if I already borrowed to invest and lost money?

Stop taking more loans, restructure debt if needed, and seek professional financial advice immediately.

5. Why do experts discourage using credit for investment?

Because interest costs and market volatility combined create a double risk — you could lose both your investment and your borrowed funds.

Disclaimer

The information shared in this blog is for general awareness only. Every individual’s situation may differ, and the actual process or outcome can vary based on personal and legal circumstances.

.WPyFdNSA.jpg)