Borrowed to Invest? Why Using a Loan for High-Risk Investments is Dangerous

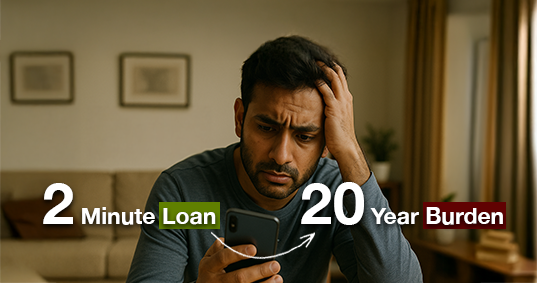

Borrowing to invest in crypto, gold, or stocks may seem profitable but often leads to mounting EMIs and debt. Learn why using loans for risky investments is dangerous, its legal impact, and safer ways to build wealth responsibly.

.CSkoRYi3.jpg)